Low Voltage Protection and Control Market by Product Type (Protection Equipment, Switching Equipment, and Monitoring Devices), End-use (Residential, Commercial, and Industrial (Oil & Gas, EV Charging), and Region - Global Forecast to 2025

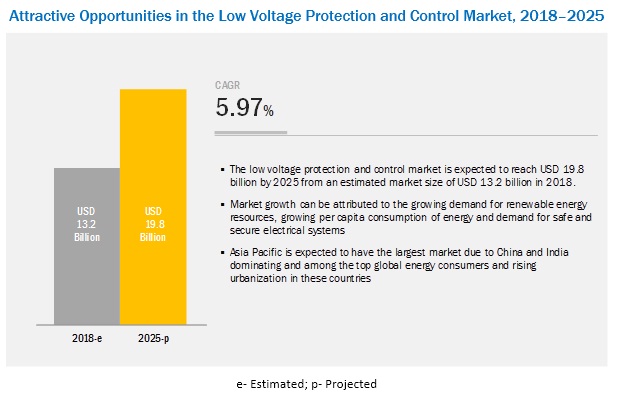

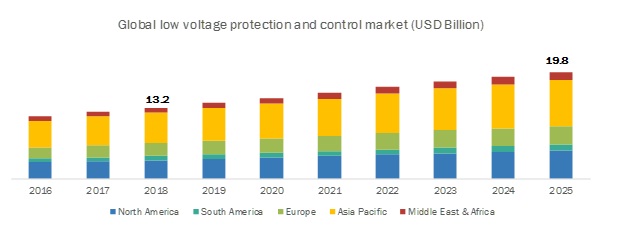

[138 Pages Report] The global low voltage protection and control market is projected to reach a size of USD 19.8 billion by 2025, at a CAGR of 5.97%, from an estimated USD 13.2 billion in 2018. This growth can be attributed to factors such as growth in the demand for renewable energy sources, growing per capita consumption of energy, and safe and secure electrical systems.

By product type, the protection equipment segment accounts for the largest contributor in the low voltage protection and control market during the forecast period.

The report segments the low voltage protection and control, by product type, into protection equipment, switching equipment, and monitoring devices. The protection equipment segment is expected to hold the largest market share by 2025. With the increasing urbanization and rising global middle class, the growth of residential, commercial, and industrial sectors, specifically EV charging and data centers, is expected to drive the market for protection equipment

The industrial segment is expected to be the largest contributor during the forecast period.

The low voltage protection and control by end-use is segmented into residential, commercial, and industrial users. The industrial segment includes industries such as oil & gas, marine, mining, food & beverage, data center, EV charging, solar, wind, microgrid, and rail. The industrial segment is expected to dominate the low voltage protection and control market by 2025 with the increasing installation of electric vehicle charging stations, data centers, and renewable energy installations. EV charging stations are expected to have the highest growth rate with several countries offering incentives and increased sales of electric vehicles.

Asia Pacific is expected to account for the largest market size during the forecast period.

In this report, the low voltage protection and control market has been analyzed with respect to 5 regions, namely, North America, Europe, South America, Asia Pacific, and the Middle East & Africa. The market in Asia Pacific is estimated to be the largest market from 2018 to 2025. China and India are among the fastest growing countries in the world with rising per capita consumption of energy due to increased industrialization and manufacturing. The countries have seen rapid infrastructure development during the past years.

The major players in the global low voltage protection and control market are ABB (Switzerland), Eaton (Ireland), Fuji Electric co. ltd (Japan), Hitachi (Japan), Rockwell Automation (US), Schneider Electric (France), Siemens (Germany), Yaskawa (Japan), CHINT Group (China), WEG SA (Brazil), Legrand (France), Toshiba (Japan), and Emerson Electric Co. (US).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2016-2025. |

|

Base year considered |

2017. |

|

Forecast period |

20182025. |

|

Forecast units |

Value (USD). |

|

Segments covered |

Product Type, End-User, and Region. |

|

Geographies covered |

Asia Pacific, North America, Europe, The Middle East & Africa, and South America. |

|

Companies covered |

ABB (Switzerland), Eaton (Ireland), Fuji Electric co. ltd (Japan), Hitachi (Japan), Rockwell Automation (US), Schneider Electric (France), Siemens (Germany), Yaskawa (Japan), CHINT Group (China), WEG SA (Brazil), Legrand (France), Toshiba (Japan), and Emerson Electric Co. (US). |

This research report categorizes the market based on product type, end-use, and region.

On the basis of product type, the low voltage protection and control market has been segmented as follows:

- Protection equipment

- Switching Equipment

- Monitoring devices

On the basis of end-use, the low voltage protection and control market has been segmented as follows:

- Residential

- Commercial

- Industrial

- Oil & gas

- Marine

- Mining

- Food & Beverage

- Data Center

- EV Charging

- Solar

- Wind

- Microgrid

- Rail

- Others (Automotive, Metal and Aluminum, Paper pulp, Textile, Cement & Glass, Plastic and Agriculture)

On the basis of Region, the low voltage protection and control market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Key Questions addressed by the report

- The report identifies and addresses key markets for low voltage protection and control, which would help manufacturers review the growth in demand.

- The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

- The report will help key players understand the strategies of their competitors better and make better strategic decisions.

- The report addresses the market share analysis of key players in low voltage protection and control market, and with the help of this, companies can enhance their revenues in the respective market.

- The report provides insights about emerging geographies for low voltage protection and control market, and hence, the entire market ecosystem can gain competitive advantage from such insights.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Market Size Estimation

2.1.1 Ideal Demand Side Analysis

2.1.1.1 Assumptions

2.1.2 Supply-Side Analysis

2.1.2.1 Calculation

2.1.3 Forecast

2.2 Some of the Insights of Industry Experts

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in the Low Voltage Protection and Control Market

4.2 Low Voltage Protection and Control, By Product

4.3 Low Voltage Protection and Control, By End-User

4.4 Low Voltage Protection and Control in APAC, By End-User and Countries

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Per Capita Consumption of Energy

5.2.1.2 Increasing Demand for Renewable Source of Energy

5.2.1.3 Demand for Safe and Secure Electrical Distribution Systems

5.2.2 Restraints

5.2.2.1 High Cost of Monitoring Devices

5.2.2.2 Gray Market and Presence of Inferior Quality Products

5.2.3 Opportunities

5.2.3.1 Growth of EV Charging Infrastructure

5.2.3.2 Growth of Data Centers

5.2.4 Challenges

5.2.4.1 Uncertainty in the Execution of Large Infrastructure Projects

5.2.4.2 Price Competition Among Major Players

6 Low Voltage Protection & Control Market, By Product (Page No. - 36)

6.1 Introduction

6.2 Monitoring Devices

6.2.1 Increasing Energy Efficiency Targets and Growing Smart Grid and Metering Systems are Driving the Market for Monitoring Devices

6.3 Protection Equipment

6.3.1 Need for Reliable and Safe Electrical Distribution System is Driving the Protection Equipment Market

6.4 Switching Equipment

6.4.1 Need for Continuous Power Supply for Critical Application is Driving the Switching Equipment Market

7 Low Voltage Protection and Control Market, By End-User (Page No. - 43)

7.1 Introduction

7.2 Residential

7.2.1 Growing Urbanization and Increasing Per Capita Consumption of Energy are Expected to Drive the Residential Sector

7.3 Commercial

7.3.1 Growing Renewable Energy Installation and Energy Efficiency Requirements are Expected to Drive the Commercial Sector

7.4 Industrial

7.4.1 Growing Electric Vehicle Infrastructure and Data Center Establishments are Expected to Drive the Industrial Sector

8 Low Voltage Protection and Control Market, By Region (Page No. - 53)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Increasing Transmission and Distribution Infrastructure Spending and Energy Efficiency Targets is Expected to Drive the Market

8.2.2 Canada

8.2.2.1 Increasing Technological Developments and Industrial Automation are Expected to Drive the Market

8.2.3 Mexico

8.2.3.1 Growing Energy Infrastructure Investment is Expected to Drive the Market

8.3 Asia Pacific

8.3.1 China

8.3.1.1 Growing Manufacturing Sector and Rising Urban Middle Class are Expected to Drive the Market

8.3.2 India

8.3.2.1 Rising Electrification and Growing Renewable Energy Installations are Driving the Market

8.3.3 Japan

8.3.3.1 Expansion of Manufacturing Sector and Renewable Energy Generation are Expected to Drive the Market

8.3.4 Australia

8.3.4.1 Growing Energy Efficiency Targets and Urbanization are Driving the Market

8.3.5 Malaysia

8.3.5.1 Growing Construction Sector and Need for Power Quality Monitoring are Driving the Market

8.3.6 Vietnam

8.3.6.1 Increasing Electrification and Growing Renewable Installations are Driving the Market

8.3.7 Rest of Asia Pacific

8.3.7.1 Energy Efficiency and Renewable Power Installations are Driving the Market

8.4 Europe

8.4.1 UK

8.4.1.1 Necessity to Increase Power System Reliability and Energy Efficiency Targets is Driving the Market

8.4.2 Germany

8.4.2.1 Growing Construction and Renewable Power Generation is Driving the Market

8.4.3 France

8.4.3.1 Industrial Automation and T&D Grid Upgrade Investment are Driving the Market

8.4.4 Spain

8.4.4.1 Rise of Commercial and Industrial Sector is Driving the Market

8.4.5 Italy

8.4.5.1 Energy Efficiency Targets and Growing Renewable Energy Installations are Driving the Market

8.4.6 Rest of Europe

8.4.6.1 Growing Renewable Energy Integration and Need for Power Monitoring are Driving the Market

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Growing Renewable Energy Power Generation and Non-Oil Sector Manufacturing Growth are Driving the Market

8.5.2 Qatar

8.5.2.1 Rising Construction Sector Investment is Driving the Market

8.5.3 South Africa

8.5.3.1 Growing Manufacturing Sector is Driving the Market

8.5.4 Rest of the Middle East & Africa

8.5.4.1 Growing Oil & Gas Sector and Renewable Energy Power Generation are Driving the Market

8.6 South America

8.6.1 Brazil

8.6.1.1 Increasing Distribution Generation and Growing Residential Sector are Driving the Market

8.6.2 Argentina

8.6.2.1 Investment in Infrastructure and Energy Efficiency Projects is Driving the Market

8.6.3 Rest of South America

8.6.3.1 Growing Renewable Power Generation is Driving the Market

9 Competitive Landscape (Page No. - 93)

9.1 Overview

9.2 Market Share Analysis

9.3 Competitive Scenario

9.3.1 New Product Launches, 20162018

9.3.2 Contracts & Agreements, 20162017

9.3.3 Mergers & Acquisitions, 20162018

9.3.4 Investments & Expansion, 20152017

9.4 Competitive Leadership Mapping

9.4.1 Visionary Leaders

9.4.2 Innovators

9.4.3 Dynamic

9.4.4 Emerging

10 Company Profile (Page No. - 99)

10.1 Company Benchmarking

(Business Overview, Products Offered, Recent Developments, MnM View)*

10.2 ABB

10.3 Eaton Corporation

10.4 Fuji Electric Co. Ltd

10.5 Hitachi

10.6 Rockwell Automation

10.7 Schneider Electric

10.8 Siemens

10.9 Yaskawa

10.10 Chint Group

10.11 Weg

10.12 Legrand

10.13 Toshiba Corporation

10.14 Emerson

*Details on Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 131)

11.1 Insights of Industry Experts

12.1 Knowledge Store: Marketsandmarkets Subscription Portal

12.2 Related Reports

12.3 Author Details

List of Tables (68 Tables)

Table 1 Key End-User Growth Rate and Transmission and Distribution Investment are the Major Determining Factors for Low Voltage Protection and Control

Table 2 Low Voltage Protection and Control Market Snapshot

Table 3 Growing Per Capita Consumption of Energy Comparison Across Major Economies, 20142016, in Mwh/Capita

Table 4 Solar and Wind Renewable Energy Targets By Major Countries

Table 5 Low Voltage Protection & Control Market Size, By Product, 20162025 (USD Million)

Table 6 Monitoring Devices Market Size, By Region, 20162025 (USD Million)

Table 7 Monitoring Devices Market Size, By Product, 20162025 (USD Million)

Table 8 Protection Equipment Market Size, By Region, 20162025 (USD Million)

Table 9 Protection Equipment Market Size, By Product, 20162025 (USD Million)

Table 10 Switching Equipment Market Size, By Region, 20162025 (USD Million)

Table 11 Switching Equipment Market Size, By Product, 20162025 (USD Million)

Table 12 Low Voltage Protection & Control Market Size, By End-User, 20162025 (USD Million)

Table 13 Industrial Low Voltage Protection & Control Market Size, By End-User, 20162025 (USD Million)

Table 14 EV Charging Industrial Application: Low Voltage Protection & Control Market Size, By Region, 20162025 (USD Million)

Table 15 Data Center Industrial Application: Low Voltage Protection & Control Market Size, By Region, 20162025 (USD Million)

Table 16 Solar Industrial Application: Low Voltage Protection & Control Market Size, By Region, 20162025 (USD Million)

Table 17 Oil & Gas Industrial Application: Low Voltage Protection & Control Market Size, By Region, 20162025 (USD Million)

Table 18 Wind Industrial Application: Low Voltage Protection & Control Market Size, By Region, 20162025 (USD Million)

Table 19 Residential: Global Low Voltage Protection and Control Market Size, By Region, 20162025 (USD Million)

Table 20 Commercial: Global Market Size, By Region, 20162025 (USD Million)

Table 21 Industrial: Global Market Size, By Region, 20162025 (USD Million)

Table 22 Industrial Market Size, By End-User, 20162025 (USD Million)

Table 23 Low Voltage Protection and Control Market Size, By Region, 20162025 (USD Billion)

Table 24 North America: Low Voltage Protection and Control Market Size, By Country, 20162025 (USD Million)

Table 25 North America: Market Size, By Product, 20162025 (USD Million)

Table 26 North America: Market Size, By Application, 20162025 (USD Million)

Table 27 North America: Market Size, By Industrial Application, 20162025 (USD Million)

Table 28 US: Market Size, By Equipment, 20162025 (USD Million)

Table 29 Canada: Market Size, By Equipment, 20162025 (USD Million)

Table 30 Mexico: Market Size, By Equipment, 20162025 (USD Million)

Table 31 Asia Pacific: Low Voltage Protection and Control Market Size, By Country, 20162025 (USD Million)

Table 32 Asia Pacific: Market Size, By Product, 20162025 (USD Million)

Table 33 Asia Pacific: Market Size, By Application, 20162025 (USD Million)

Table 34 Asia Pacific: Market Size, By Industrial Application, 20162025 (USD Million)

Table 35 China: Market Size, By Equipment, 20162025 (USD Million)

Table 36 India: Market Size, By Equipment, 20162025 (USD Million)

Table 37 Japan: Market Size, By Equipment, 20162025 (USD Million)

Table 38 Australia: Market Size, By Equipment, 20162025 (USD Million)

Table 39 Malaysia: Market Size, By Equipment, 20162025 (USD Million)

Table 40 Vietnam: Market Size, By Equipment, 20162025 (USD Million)

Table 41 Rest of Asia Pacific: Market Size, By Equipment, 20162025 (USD Million)

Table 42 Europe: Low Voltage Protection and Control Market Size, By Country, 20162025 (USD Million)

Table 43 Europe: Market Size, By Product, 20162025 (USD Million)

Table 44 Europe: Market Size, By Application, 20162025 (USD Million)

Table 45 Europe: Market Size, By Industrial Application, 20162025 (USD Million)

Table 46 UK: Market Size, By Equipment, 20162025 (USD Million)

Table 47 Germany Energy Efficiency and Renewable Energy Targets, 20202050

Table 48 Germany: Market Size, By Equipment, 20162025 (USD Million)

Table 49 France: Market Size, By Equipment, 20162025 (USD Million)

Table 50 Spain: Market Size, By Equipment, 20162025 (USD Million)

Table 51 Italy: Market Size, By Equipment, 20162025 (USD Million)

Table 52 Rest of Europe: Market Size, By Equipment, 20162025 (USD Million)

Table 53 Middle East & Africa: Low Voltage Protection and Control Market Size, By Country, 20162025 (USD Million)

Table 54 Middle East & Africa: Market Size, By Product, 20162025 (USD Million)

Table 55 Middle East & Africa: Market Size, By Application, 20162025 (USD Million)

Table 56 Middle East & Africa: Market Size, By Industrial Application, 20162025 (USD Million)

Table 57 Saudi Arabia: Market Size, By Equipment, 20162025 (USD Million)

Table 58 Qatar: Market Size, By Equipment, 20162025 (USD Million)

Table 59 South Africa: Market Size, By Equipment, 20162025 (USD Million)

Table 60 Rest of Middle East & Africa: Market Size, By Equipment, 20162025 (USD Million)

Table 61 South America: Low Voltage Protection and Control Market Size, By Country, 20162025 (USD Million)

Table 62 South America: Market Size, By Product, 20162025 (USD Million)

Table 63 South America: Market Size, By Application, 20162025 (USD Million)

Table 64 South America: Market Size, By Industrial Application, 20162025 (USD Million)

Table 65 Brazil: Market Size, By Equipment, 20162025 (USD Million)

Table 66 Argentina: Market Size, By Equipment, 20162025 (USD Million)

Table 67 Rest of South America: Market Size, By Equipment, 20162025 (USD Million)

Table 68 Developments By Key Players in the Market, 20152018

List of Figures (34 Figures)

Figure 1 Monitoring Devices Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 2 Industrial Segment is Expected to Lead the Low Voltage Protection and Control Market During the Forecast Period

Figure 3 Asia Pacific is Expected to Dominate the Low Voltage Protection and Control Market During the Forecast Period

Figure 4 Increasing Demand for Renewable Energy Sources Globally is Expected to Drive the Low Voltage Protection and Control Market During the Forecast Period

Figure 5 Protection Equipment Segment Led the Low Voltage Protection and Control in 2017

Figure 6 Industrial Segment is Expected to Grow Globally in the Low Voltage Protection and Control Market During the Forecast Period

Figure 7 China Was the Largest Low Voltage Protection and Control in Asia Pacific in 2017

Figure 8 Drivers, Restraints, Opportunities, and Challenges

Figure 9 Global Primary Energy Consumption Share, 2017 (In %)

Figure 10 Projected Share of Renewables in Electricity, Heat, and Transport, 20172023 (%)

Figure 11 Global Projected Energy Demand, 20152040, (In Quadrillion Btu)

Figure 12 Publicly Accessible Chargers, By Country, 20142017

Figure 13 Protection Equipment is Expected to Hold the Largest Market During Forecast Period

Figure 14 Industrial Segment is Expected to Dominate the Market During Forecast Period

Figure 15 Regional Snapshot: Middle East & Africa Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Market Share (Value), By Region, 2017

Figure 17 North America: Market Snapshot

Figure 18 North American Electric Vehicle Supply Equipment Stock Comparison, US vs Canada, 20162017

Figure 19 Asia Pacific: Market Snapshot

Figure 20 Key Developments in the Low Voltage Protection and Control During 20152018

Figure 21 Market Share Analysis, 2017

Figure 22 Low Voltage Protection and Control (Global) Competitive Leadership Mapping, 2017

Figure 23 ABB: Company Snapshot

Figure 24 Eaton Corporation: Company Snapshot

Figure 25 Fuji Elctric Co.Ltd: Company Snapshot

Figure 26 Hitachi: Company Snapshot

Figure 27 Rockwell Automation: Company Snapshot

Figure 28 Schneider Electric: Company Snapshot

Figure 29 Siemens: Company Snapshot

Figure 30 Yaskawa: Company Snapshot

Figure 31 Weg: Company Snapshot

Figure 32 Legrand: Company Snapshot

Figure 33 Toshiba Corporation: Company Snapshot

Figure 34 Emerson: Company Snapshot

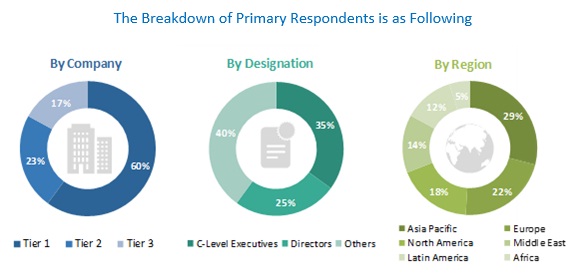

This study involved 4 major activities in estimating the current market size for low voltage protection and controls. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. Thereafter, the market breakdown and data triangulation was done to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global low voltage protection and control market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The low voltage protection and control market comprise several stakeholders such as end-product manufacturers, transmission and distribution operators, residential and end-users in the supply chain. The demand side of this market is characterized by its applications such as commercial, residential, oil & gas, marine, mining, datacentre, EV charging, solar, wind, microgrid, rail, and others. The supply side is characterized by advancements in protection technologies such as comprehensive and fast reacting products and increased emphasis on low voltage protection and controls operational lifetime. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global low voltage protection and control market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the commercial, residential, oil & gas, marine, mining, datacenter, EV charging, solar, wind, microgrid, rail, and others.

Report Objectives

- To define, describe, and forecast the global low voltage protection and control market by product type, end-user, and region

- To provide detailed information on the major factors influencing the growth of the low voltage protection and control market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To track and analyze the competitive developments such as contracts & agreements, expansions, new product developments, mergers & acquisitions, and partnerships in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Low Voltage Protection and Control Market